AI-powered trading systems have the unmatched ability to carefully examine enormous datasets, identify complex patterns, and carry out trades at rates that are faster than those of human traders. AI traders have a clear advantage in predicting price changes and making money.

In this talk, we’ll explore the top ten AI trading strategies that are becoming increasingly popular among hedge funds, proprietary trading companies, and individual traders. We’ll explain how these strategies work, go over their advantages and disadvantages, and discuss how traders use them to make money.

The 10 AI Trading Strategies Market Share by Popularity

The 10 AI Trading Strategies Comparison Sheet

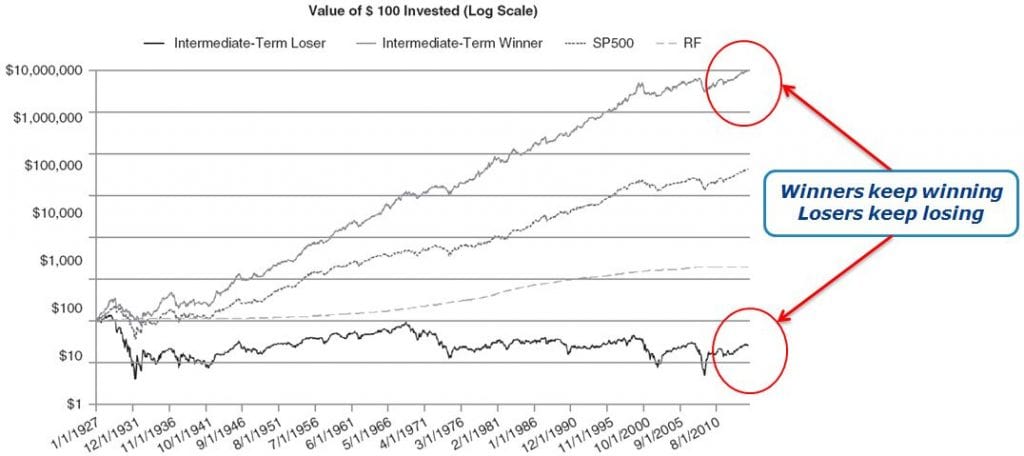

1. AI Quantitative Momentum Trading

Operational Mechanism:

AI algorithms underpin this strategy by meticulously monitoring price trends across diverse securities such as stocks, futures, and currencies. It meticulously discerns securities exhibiting upward price momentum.

Pros:

Cons:

Implementation Recommendations:

2. AI Mean Reversion Trading

Operational Mechanism:

This strategy thrives on the propensity of markets to revert to their mean or average. AI algorithms undertake long positions in securities trading below the mean price and short positions in those trading above it, foreseeing an eventual reversion.

Pros:

Cons:

Implementation Recommendations:

3. AI Pattern Recognition Trading

Operational Mechanism:

AI algorithms are trained to discern historical price patterns that herald high-probability trading opportunities. Upon identifying these patterns, AI automatically initiates lucrative trades.

Pros:

Cons:

Implementation Recommendations:

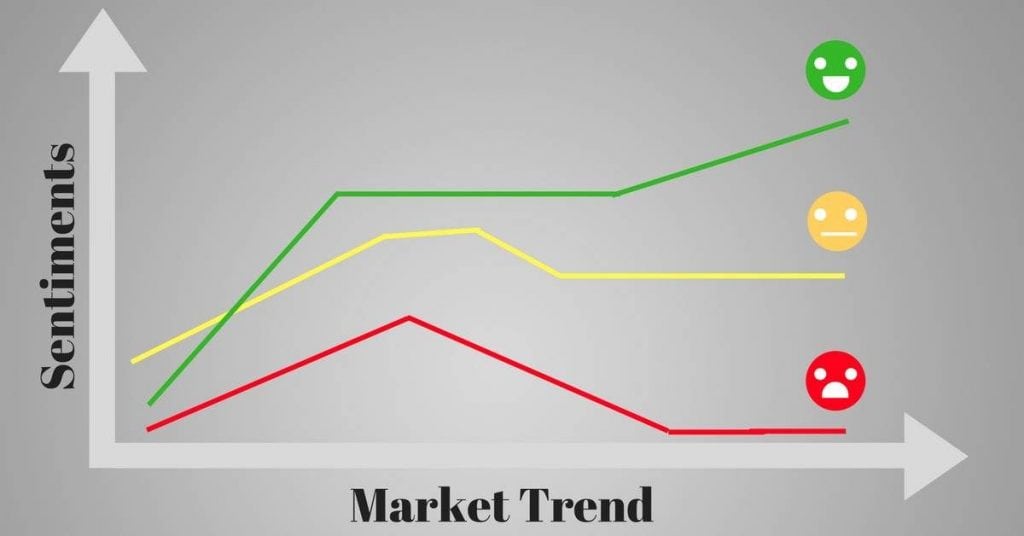

4. AI Sentiment Analysis Trading

Operational Mechanism:

AI algorithms scrutinize news headlines, articles, blogs, forums, and social media to gauge bullish or bearish sentiment. NLP algorithms and machine learning models amalgamate these signals, enabling automated trades in alignment with prevailing sentiment.

Pros:

Cons:

Implementation Recommendations:

5. AI Algorithmic Hedging

Operational Mechanism:

AI systems examine relationships between asset classes, securities, and derivatives to discern effective hedging opportunities. Algorithms ascertain optimal hedging position size and timing, dynamically adapting portfolios to sustain the hedge as market conditions evolve.

Pros:

Cons:

Implementation Recommendations:

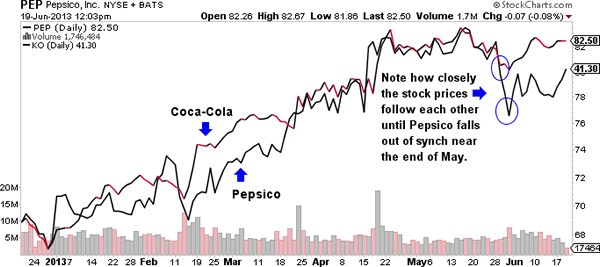

6. AI Statistical Arbitrage Trading

Operational Mechanism:

This high-frequency trading strategy strives to capitalize on short-term mispricings in correlated securities. AI algorithms vigilantly monitor pricing relationships between assets, such as stocks and their ETFs. Trades are promptly initiated upon detecting pricing discrepancies, leveraging millisecond execution speeds to exploit minute disparities.

Pros:

Cons:

Implementation Recommendations:

7. AI Algorithmic Execution Trading

Operational Mechanism:

AI deploys its analytical prowess to enhance trade execution. It evaluates market liquidity, volatility, and microstructure to determine the optimal execution strategy. Large orders are subdivided into smaller segments for discreet execution, and trades are timed to mitigate costs and slippage. Self-learning algorithms continually refine execution performance.

Pros:

Cons:

Implementation Recommendations:

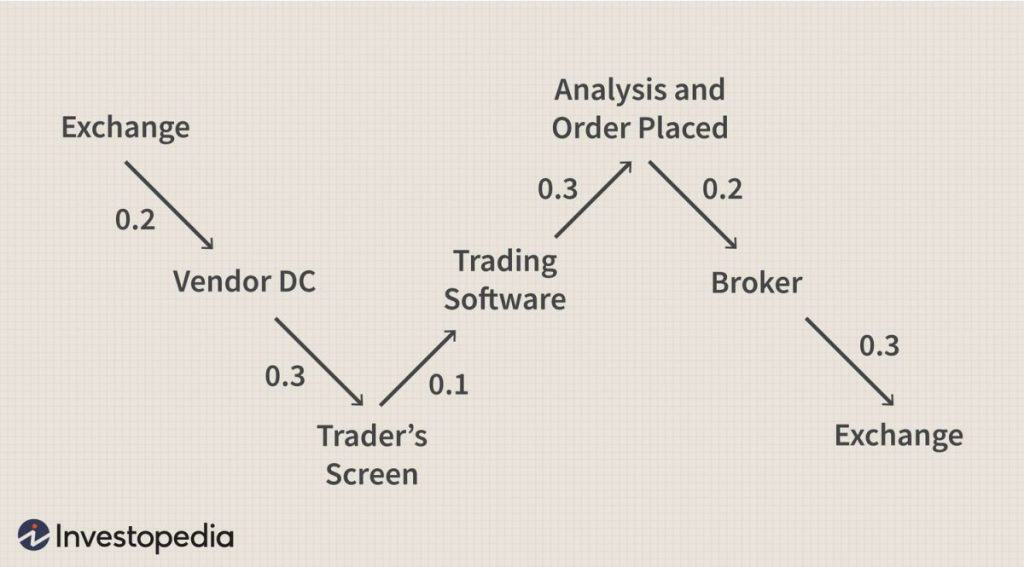

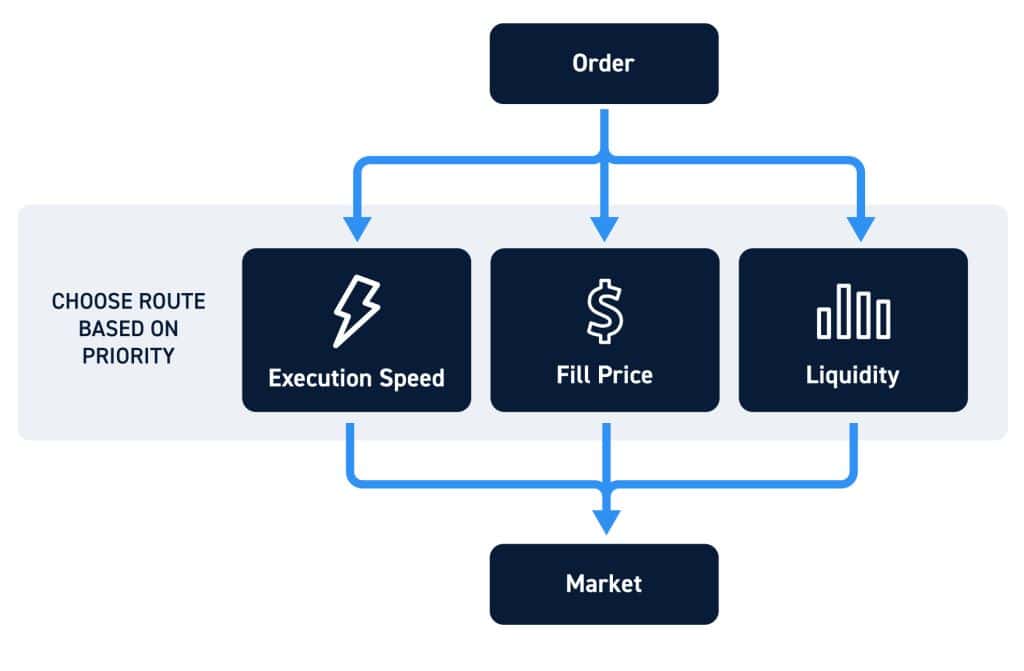

8. AI Smart Order Routing

Operational Mechanism:

AI algorithms closely monitor and assess order book data across diverse exchanges and liquidity pools. Based on factors like order size, prices, and current market conditions, AI algorithms select the most advantageous venue for order execution. Orders are adeptly allocated across multiple destinations to minimize the disclosure of trading strategies, and self-learning models perpetually augment performance.

Pros:

Cons:

Implementation Recommendations:

9. AI Event-Driven Trading

Operational Mechanism:

AI systems ingest and interpret vast quantities of news, earnings data, SEC filings, and economic releases. Actionable insights are extracted to predict potential market impacts. Trades are automatically executed to profit from anticipated price movements stemming from significant events.

Pros:

Cons:

Implementation Recommendations:

10. AI/Human Collaborative Trading

Operational Mechanism:

This strategy amalgamates human creativity with AI’s computational prowess. Experienced traders harness AI for data analysis and pattern recognition. AI models enhance human trading decisions through automated signals, alerts, and analytics. Humans contribute creative inputs like strategy design, intuition, and market expertise.

Pros:

Cons:

Implementation Recommendations:

The Pinnacle of AI Trading Systems

The successful implementation of these AI trading strategies necessitates specialized expertise. The optimal approach entails collaborating with established hedge funds, proprietary trading firms, or fintech vendors equipped with proven AI systems. The supremacy of artificial intelligence empowers traders to execute strategies with superhuman swiftness, precision, and analytical acumen.

While AI trading is still evolving, these technologies have exhibited remarkable potential for reshaping the landscape of investment and trading. As more entities adopt and innovate with AI, anticipate its integral role in capital markets and portfolio management. The competitive edge bestowed by AI algorithms implies that this technology is poised to become an indispensable capability for all serious market participants in the future.

Comparison of Key Features

When considering the application of AI in trading, it’s essential to keep these best practices in mind:

Key Benefits of AI Trading

AI trading offers several advantages over traditional trading approaches:

Risks and Challenges of AI Trading

AI trading also comes with its share of risks and challenges:

The Future of AI in Trading

AI is rapidly gaining traction in the trading and investment landscape. As algorithms become more powerful and accessible, AI will continue transforming how markets and participants operate. However, responsible oversight and governance will be critical to building trust and ensuring positive societal outcomes.

Traders seeking to leverage AI should begin by deeply understanding their strategy, data, and markets so they can apply AI judiciously to enhance their edge. With the right approach, AI can become a valuable addition rather than a black box prone to overpromising.

FAQs

What is AI algorithmic trading?

AI algorithmic trading uses computer programs with automated rules and AI/ML to make trading decisions, place orders, and manage trades with minimal human intervention.

What are the main benefits of AI trading strategies?

AI provides speed and precision in data analysis, pattern recognition, order execution, risk management, and other aspects that human traders cannot match. This gives an edge to AI trading strategies.

What risks are associated with AI trading?

Potential risks include overfitting models to historical data, coding errors in algorithms, excessive trading, and susceptibility to flash crashes and volatility. Proper development, testing, and risk controls are essential.

What skills are required to develop profitable AI trading systems?

Successful development requires expertise in AI/machine learning, quant trading strategies, market microstructure, data science, backtesting, coding, and predictive analytics. A multidisciplinary team is ideal.

How can traders implement AI trading strategies?

A: Traders can either build in-house AI capabilities, purchase off-the-shelf AI trading platforms, or invest through hedge funds and trading firms with established AI trading infrastructure.

What is the future outlook for AI trading technologies?

AI is expected to become integral to capital markets and trading as adoption grows. The competitive advantages provided by AI will likely become essential for all serious traders in the future.

Source: mPost