The NFT market continues its rough patch, with holders selling their digital assets at a substantial loss and marketplaces seeing both volume and users plummeting.

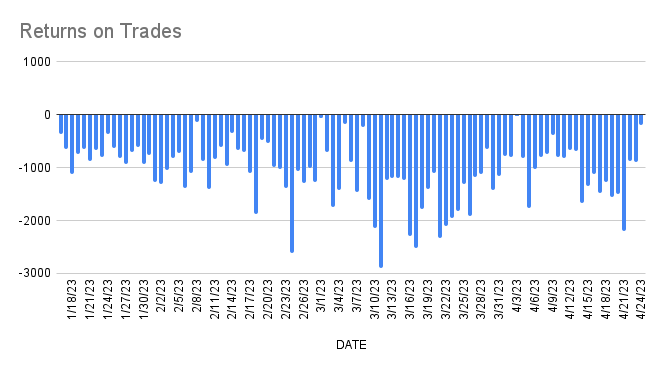

Losses on secondary sales are averaging 1,000 ETH ($1.9M) per day, with spikes as high as 3,000 ETH, according to NFTstatistics, a popular Twitter account that tracks the non-fungibles sector.

Daily Returns On NFT Secondary Sales

“As NFT market capitulation sets in, cryptonative IP projects, while initially having started out as [veblen] goods, will need to turn their assets into productive assets in order to remain afloat.” 1kx partner pet3rpan noted.

In the past 30 days, blue-chip NFTs like CryptoPunks, Bored Ape Yacht Club, and Moonbirds have experienced drops of 18%, 16%, and 13%, respectively. The market took a hit earlier this month when a single holder sold 27 Bored Ape Yacht Club NFTs, worth $3 million at the time, causing a cascade effect on the market.

Meanwhile, NFTs posted as collateral on lending protocols are being liquidated, with the majority of liquidations happening on NFTfi. The market downturn has caused daily volume and active users across all NFT marketplaces to decline sharply over the past three months.

Daily NFT Traders. Source: Dune

Ordinals Inscriptions

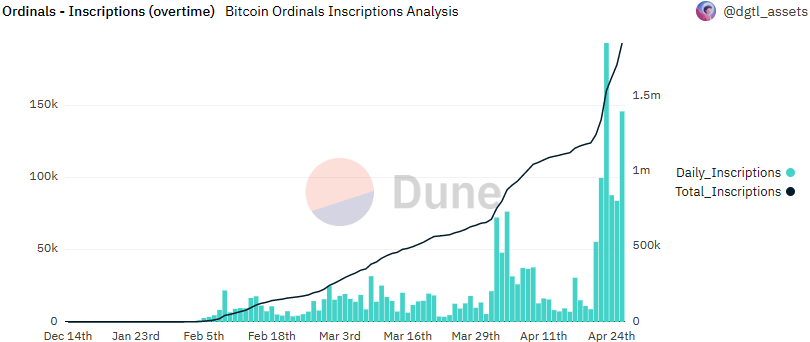

Ordinals – Bitcoin NFTs – continue to gain traction among NFT enthusiasts. Total inscriptions have surpassed 1.85 million, representing an 85% increase in just two weeks, with the total fees generated by the protocol reaching $5.3 million.

Ordinals Inscriptions Over Time

NFTfi Points Program

In response to the market downturn, NFT lending protocol NFTfi has announced OG points, a loyalty-based rewards program to incentivize users to use the platform. Borrowers and lenders of eligible collections can claim OG points, which will eventually become redeemable for blockchain tokens.

Source: The Defiant